Winter Drives Up Energy Market Rates – Poland Ranks Second in Price Hikes

November brought a continuation of the upward trend in Europe, where average prices on the Day-Ahead Market jumped by 7.3%, reaching a level of 99.08 EUR/MWh. The winter season and lower temperatures fueled demand, which—coupled with weaker generation from Renewables (RES)—drove the rates to the third-highest level this year. This situation was particularly felt in Poland (an 18.6% increase to 123.68 EUR/MWh), which became the second most expensive market in the region due to low wind capacity factors. Interestingly, this occurred contrary to the fuel markets—natural gas and coal became markedly cheaper thanks to positive geopolitical signals.

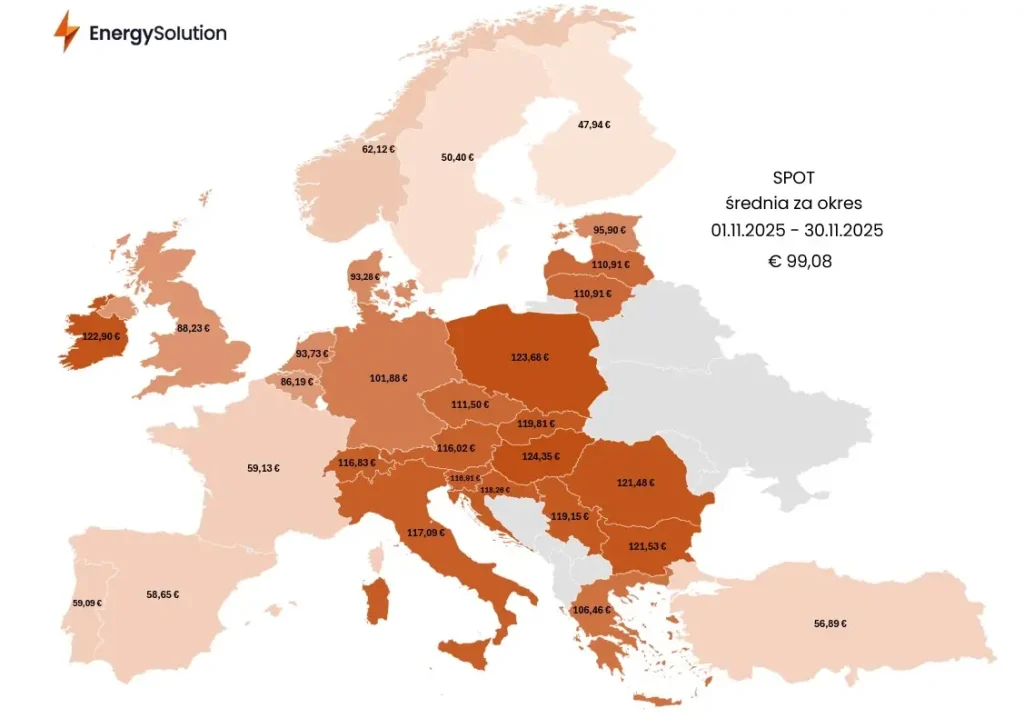

The map of average energy prices was prepared by Energy Solution experts: Krzysztof Mazurski, Director of the Portfolio Management Department, and Wojciech Listoś, Wholesale Energy and Gas Market Analyst.

Key Information:

- Price Increase in Europe: The average energy price on the Day-Ahead Market increased for the third consecutive month (+7.3% m/m), reaching 99.08 EUR/MWh.

- Poland on the Price Podium: The domestic market recorded a sharp increase of 18.6% (to 123.68 EUR/MWh), marking the second-highest result in Europe, just behind Hungary.

- Reasons for the Increases: The key factors were lower wind capacity factors in Poland (a 32% decrease m/m) and an increase in the share of lignite (brown coal) in the region’s energy mix to 22%.

- Stabilization on the Forward Market: The annual contract for 2026 (BASE Y-26) remained at 84.18 EUR/MWh, recording only a symbolic decrease of 0.21 EUR/MWh compared to October.

- Rally in the CO2 Market: Emission allowances (EUA) gained over 6% in value, driven by the activity of investment funds.

- Gas Price Drops: Natural gas (TTF) contracts became 7.75% cheaper m/m, reaching new historical lows thanks to stable supplies and geopolitical optimism.

Fig. 1: Average SPOT Price in November 2025

The average Day-Ahead Market (DAM) supply price for the entire described zone has been growing for the third consecutive month. As a result of the start of the winter season, it gained 6.79 EUR/MWh (7.3%) compared to October, reaching a value of 99.08 EUR/MWh. Although the growth dynamic is twice as low as the previous month, the November spot price recorded the third-highest reading this year—just behind January (114.66 EUR/MWh) and February (130.34 EUR/MWh).

The price increases on the spot market were again dictated by worsening weather, mainly the drop in temperature across Europe and increased demand for electricity. A higher share of onshore turbines (by 12 p.p. m/m) in the generation structure of Poland’s neighboring countries slightly mitigated the rise. However, the share of lignite (brown coal) simultaneously increased by 6 p.p. m/m (to 22%), which is the highest reading this year. It is also worth noting that seventeen countries exceeded the 100 EUR/MWh threshold, and the average for Norway, Sweden, and Finland—usually the cheapest markets—rose by 12.41 EUR/MWh (30.2%) m/m, reaching 53.48 EUR/MWh.

In Poland, prices rose by 19.42 EUR/MWh (18.6%) to a value of 123.68 EUR/MWh, which means the appreciation dynamic was more than twice as high compared to the described zone. Moreover, this was the second-highest result, just behind Hungary (124.35 EUR/MWh). The deterioration of the national result was most significantly influenced by lower wind capacity factors, which averaged 2.2 GW—a result 32% lower m/m and 28% y/y. The demand of the National Power System and the power generation from centrally dispatched generating units were at similar levels to the previous year.

Fig. 2: Average BASE Y-26 Price in November 2025

The Forward Market price of electricity, represented by the annual contract for 2026, averaged 84.18 EUR/MWh—a value lower by just 0.21 EUR/MWh compared to October. This is a small change, especially when compared to the appreciation of CO2 emission allowance quotations, which gained as much as 6.01% over the same period. However, annual instruments remained supported by falling energy commodity prices: TTF gas index quotations dropped by an impressive 7.75% m/m, and ARA API2 coal by 1.44% m/m.

Funds Play on CO2 Increases

CO2 emission allowances (EUA) were invariably the strongest performing instrument linked to the energy sector, growing by as much as 6.01% m/m. Thus, despite consolidation lasting for most of the month, the EUA price continued the gains started at the beginning of September. From a technical analysis perspective, allowance quotations have been in a long-term upward trend since the beginning of April, when they started at 61 EUR/t—the scale of the increase is therefore 21 EUR/t, or 34%. This correlates with the net long position of investment funds, which stood at almost 110 million tonnes at the beginning of December. This is the highest value in several years and has been systematically growing since the second half of August, when it was around 20 million tonnes, representing an increase of 90 million tonnes (+450%). This confirms the still-high correlation between the actions of investment funds and the EUA price.

The most important events, from the perspective of market participants, took place at the beginning of the month. On November 3, the German government announced electricity price subsidies for industry, which significantly revitalized the demand side and resulted in a one-day increase of over 3 euros. Subsequently, on November 4, the Environment Council meeting took place—following a vote by ministers, the entry of the ETS2 system was extended by a year and is tentatively scheduled to enter into force in 2028. However, the EU’s climate policy itself was maintained, confirmed by the goal of reducing emissions by 90% by 2040 compared to 1990 levels.

During the winter season, demand pressure on the CO2 emission allowance market is likely to be sustained. According to the latest Vertis forecasts, the reference EUA price in Europe could average 106 EUR/t in 2026. This would be an increase of about 29% compared to the current price of the MidDec-25 contract. The gain is expected despite a softer decline in free allowance allocations and a less strained market situation. It should also be noted that the CBAM mechanism will be fully implemented next year, which may also play a significant price-forming role. Vertis analysts added that the annual market balance should be around -175 million tonnes, compared to a tighter level of -190 million tonnes predicted earlier.

Thaw in the Fuel Market and Geopolitical Hopes

TTF annual contract quotations dropped by 7.75% m/m and deepened their historical minimum. The situation was similar for other forward instruments. The price decrease mainly results from solid fundamentals (high gas flows from Norway and LNG from the United States combined with relatively low demand due to higher temperatures) and an improvement in the geopolitical situation.

In the second half of November, successful talks took place between the United States and Ukraine in Geneva, signaling progress towards ending the war. On Tuesday, November 25, an agreement was reached on key points of the peace plan. Recent weeks show that the geopolitical situation plays a decisive role in shaping natural gas prices.

The European coal market remained stable—quotations for the annual ARA API2 contract depreciated by 1.44% m/m and continue to hover around the round barrier of 100 USD/t. According to Montel analysts, increasing LNG supplies to Europe from across the Atlantic starting in 2026 will increasingly displace coal demand, which may result in a decline in imports of about 5 million tonnes next year and thus price depreciation. According to data, imports of thermal coal to EU-27 countries amounted to just 20.2 million tonnes last year, a decrease of about half compared to the 2023 level.